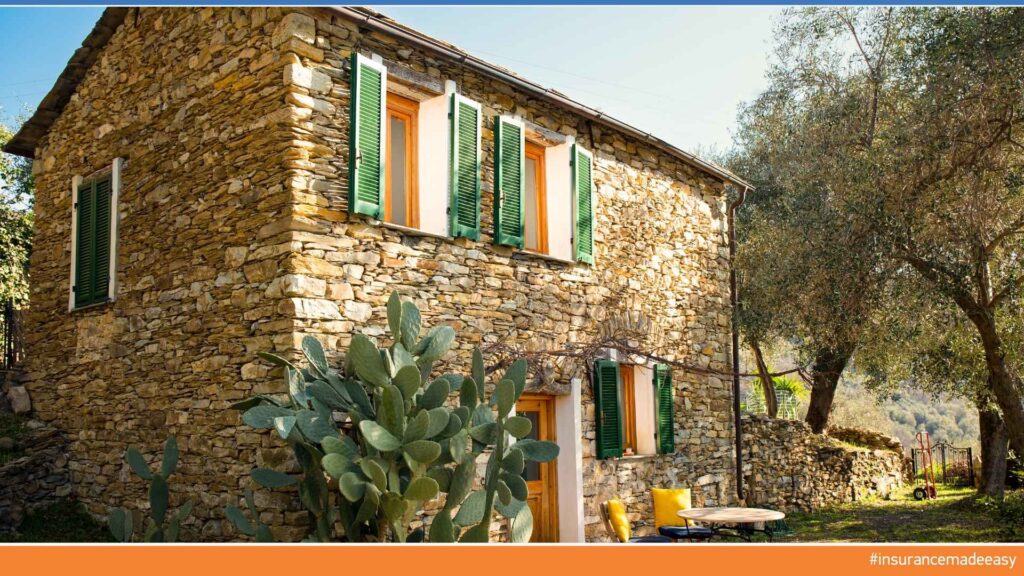

A vacation home is a dream for many people. Those who own one know the joy this choice brings, the opportunity to relax. It is a place where memories are made and where we reconnect with ourselves, breaking away from the daily routine. However, as emotionally valuable as it is, it is also a significant financial investment that requires proper protection.

Unfortunately, many vacation home owners neglect insurance. You can effectively secure your property and protect it long-term from many risks, keeping the joy it brings to your life alive. However, you need to know three secret exceptions. These will help you be cautious so that if something unfortunate happens, you will receive your compensation.

Don’t Underestimate the Risks

Stop underestimating the risks that threaten a vacation home that is not permanently occupied. Being absent for long periods leaves the house exposed to burglaries, vandalism, fires, floods, and even damage caused by simple neglect, like a plumbing leak that goes unnoticed in time.

Unfortunately, many fall into the trap of thinking that because the house isn’t lived in year-round, it doesn’t require much protection or maintenance. But that’s not true. These homes need a more specialized insurance approach precisely because they lack daily supervision. The right coverage must account for these unique circumstances and provide substantial protection even when the property remains closed for months.

Secret #1: Risk of Fire from the Forest

It is essential to make sure by checking your policy that you are covered in case of a fire comes from the forest. If a forest fire spreads and approaches your home and the unfortunate happens, you need to have planned ahead and included this coverage as a top priority in your policy, because it is not always automatically included in a standard fire insurance.

If you have a policy but aren’t sure whether this risk is covered, contact your insurance advisor immediately, and if it’s not included, add this coverage.

This coverage is the only way to ensure prompt compensation, and under no circumstances should it be left to chance.

Secret #2: Don’t Leave the House Unoccupied for More Than 30 Consecutive Days

Many insurance policies include specific coverage exclusions if the house is unoccupied for more than 30 consecutive days. So, if a risk covered by these exclusions occurs, the insurance company will not cover the damage due to this clause.

That’s why it’s very important to read your insurance policies and terms carefully and know exactly what you are covered for.

What you need to do is visit the house often and stay at least one night. This way, you will not only monitor the condition of the property but also be able to notice immediately if any damage occurs and take corrective action before the situation worsens.

Secret #3: Adequate Maintenance

Keeping the outdoor area clean is crucial to prevent a potential fire. You must clear the property of dry grass, debris, trash, and dry branches that are flammable materials, especially during the summer months.

If this is neglected, the insurance company may refuse compensation because you failed to maintain your property, which is your responsibility.

Insuring your vacation home can be a simple and easy process with SoEasy Insurance.

With proper planning, comprehensive coverage, and attention to detail, you can ensure with us that the home you love remains safe while you take care of what matters most to you.

Talk today with a member of our team or one of the many insurance advisors who collaborate with us.