George Natar – B.Sc. M.Sc, MCyHRMA – Certified Business and Insurance Trainer

Introduction

Insurance distribution networks and especially insurers, or more properly referred to in law as “insurance intermediaries”, are facing new market challenges with an increased need for technological adaptation, and the battle to protect their market shares and profitability.

Specifically, the approach of the new generation has different requirements in the insurance sector, always compared to the older generations. These are the main reasons that force us to make strategic changes in order to become more competitive in the tight economic environment, which creates a need for adjustments, uncertainty and increased operating costs.

Central to this work is the proper planning and organization of operations, with modern alternatives to be used to meet new needs. The new legislation on Insurance operations (the famous IDD) that started in Cyprus in 2019, institutionalizes the distribution with compulsory training needs, and requires the connection of all insurance operations with the institutional framework and specialization in the field in which everyone deals.

All these, without being an end in itself, but a necessity, creates the tendency to strengthen the morale of the insurer and his further devotion to the insurance institution, ie the rules of operation and ethics.

Advice and sales standards in case of non-advice

Article 394 (f) of the legislation explicitly states, inter alia, that “the distributor of insurance products identifies the requirements and needs of the customer and provides information about the insurance product in order to take an up-to-date decision in accordance with its requirements and needs; and to provide a personalized recommendation “… And it continues … “in relation to the distribution of insurance products of the General Insurance sector, the information is provided with a standard information document”. That is, our well-known I.P.I.D.

In other words, it is clear that this legislation does not only mean the Life sector, as many may mistakenly think, and that every customer needs collective financial and insurance guidance. And this is what makes the insurer stand out.

Hierarchy of the Most Valuable Asset of customers

To translate this legislation a little more “everyday”, the insurer should prioritize the needs of the clients always starting from the Ability of the client to generate income.

This value of life can be affected by various unexpected events that will burden the income and have consequences for a normal life, such as the impact of a health or an accident, the destruction of property such as the house and its valuables, from a fire or a natural event, lightning, earthquake, climate change and so on. We must not forget the most modern necessary commodity, the car, since trafficking is the most common and daily need for everyone, and which can cause disproportionate financial costs of liability after an unfortunate event. And of course there are others, not just what is seen, but also what is not seen, such as unemployment, cyberbullying, legal protection, professional liability, and more.

The heart of the insurer’s code of conduct

Therefore, it is no secret to say that here “there is a great code” the moral and professional code, since everything must be done decently, honestly, and as much as it seems excessive, altruism is needed, since the insurer offers selflessly many times, all the knowledge and advice he may have been interested in, posting only a “small” commission on any insurance plan that will convince the customer to buy. The code of ethics of the insurance intermediary is a large text with many “shoulds”, but its heart is perhaps more “simple ???” …

- Act with the highest ethical standards and integrity.

- Act in the best interest of each customer.

- Provide high quality services.

- Treat people fairly regardless of age, disability, gender, marriage / urban cohabitation, pregnancy / motherhood, race, religion or belief, gender and sexual orientation.

Dedication to the Insurance Institution

Very relevant here at this point is the song, based on the words of Father Kennedy: “When the going gets tough, the tough get going…”, we sang the little old ones, in 1985 by Billy Ocean.

It takes dedication to what we do. So we have to be strict (tough). What we call “duty to the state”, because what we do, we don’t do it for one, nor for a few, we do it for our society.

And the legislation here wants us “A competent and suitable person (Fit and Proper) – Example of Ethics and Conduct”. The State through the Legislation determines the Minimally Acceptable behavior of the middlemen. However, they do not constitute an Integrated Conduct Framework. We must know the Legislative Framework of the Insurance Market, have a registration in the Mediation Register and possess the Relevant Registration Certificate.

The Minimum Qualifications for our Registration in the Register are: To have at least a High School Diploma, a Certificate of Basic Insurance Training (PVAK) for the respective branch or branches we deal with, another Certificate approved by the Insurance Advisory Committee after examinations, and continuous professional training.

To be a “Fit” Person, ie integrity, Good Reputation, special knowledge, experience, good Financial Status, and to be a “Proper” person, ie NOT to have been convicted of criminal offenses (eg forgery) , theft, fraud, usury, bribery) etc.

It also requires dedication to the “duty of Continuing Professional Development”. Our main function is information and transparency, therefore there is a constant need for customer information, which is one of the basic provisions of the law that governs the work of insurance companies. The consumer must be informed clearly and precisely about the characteristics of the products offered and the procedures to be followed.

Declared in the Law are the Terms of Customer Information, ie the Provision of information to customers for Transparency, the Provision of advice based on sales standards.

The Insurer’s Ethics

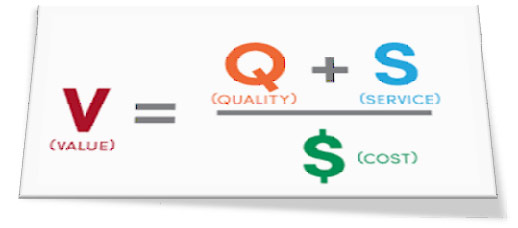

And “Value”, in order to be achieved, needs “Quality” and “Care” against any “Cost” that arises, as shown by the corresponding formula in the picture. To achieve this we need a Lighthouse, or rather a Goal, an Ithaca. And as our own Greek poet Konstantinos Kavafis told us, in 1911 “When you go to Ithaca, wish that the road is long, full of adventures, full of knowledge … always keep Ithaca in mind, getting there is your destination.

Best many years to take, to rich with what you won on the road, Ithaca gave you the nice trip. Without it you would not be on the road.

So wise that you became, with so much experience, you would already understand what Ithaca means “.

Ethics and Loyalty Completion: The Theory of Goal Setting for the Insurer

Goals must be S.M.A.R.T. that is, “modest, well-dressed”. And this is analyzed in five (5) criteria, ie Specific – Measureable – Achieved – Realistic and Time-bound.

As the difficulty increases, so does the effort. The more involved you are in setting goals, the more effort you put into it. And the benefits of Goal setting are manifold and determine the level of quality required: Starting with the most direct decision making that helps us adapt, and the deeper analysis and comparison of the elements that give us a clear path. Continuing with the consequence of all this, which is nothing more than saving productive time, by avoiding overlapping duplicate tasks, and with economies of scale that are created after copying successful recipes and eliminating failures. They are all controlled and dedicated.