George Natar – B.Sc, M.Sc, MCyHRMA – Certified Business and Insurance Trainer

The Leader always stands out

By doing a little research on the subject of “Leadership” one easily discovers that there are many definitions and concepts, just as there are many different theories. These theories are often grouped into categories according to the ideas expressed by each theory.

“Leadership is a process of influencing an individual to accomplish goals to create projects.”

The leader defines the mission and general framework of action based on personal and professional values and influences, intentionally or not, the people around him to follow him towards their fulfillment. Leaders move the strings, convey with their abilities the necessity of changes in people’s behavior and attitude, even in changing the way an entire company operates.

Leaders, as a role, are necessary throughout society and business because they act as driving forces, regardless of whether the result will ultimately be successful or not.

In recent years, management theorists in general have distinguished four (4) different types of Leadership that have generally prevailed in our society today. These include:

- Situational Leadership,

- Commanding “Contingency” leadership

- Transactional leadership and finally…

- Transitional leadership.

Leadership in the Private Insurance Sector

Today, the volatility of the overall market is permanent and gaining intensity and scope everywhere.

We live in a time of “Crisis” in a period of great changes. Everything has become “new”, unprecedented in some sense, or needs new innovative ways of management.

“Crisis is uncertainty and in uncertainty lies the opportunity” said Lorayne Fiorillo, CEO of Raymond James Financial Strategies. “In clutter, find simplicity, from discord, get harmony, in the middle of every difficulty there is an opportunity,” said Albert Einstein.

In its etymology, the word “crisis” means a decision and a sound opinion after an assessment of the causes, the facts and the conditions in which they occurred. It is not a negative approach, on the contrary, it is positive and even pushes us to think critically, and to create. It gives us the push to innovation. And this coincides exactly with what “Leadership” really means.

Insurance Leadership is the one that will manage the “Crisis”, any “crisis”, from all aspects of influence that we face today.

Insurance companies face repeated challenges. Revival of inflation and its consequences on insured sums and premiums, return of uprate of interest which means more expensive money, strict framework of legislation which essentially increases operating costs.

And that’s not all. Insurers today must face new risks from the consequences of the pandemic (in Life, Health, Family, business), cyber threats (as the big thorn in technology that already affects us), and the very significant impact from climate change which already have enough impact on the size and frequency of losses and their consequent situations, in a vicious circle it creates for the level and scope of coverages, and consequently on insurance premiums.

All these challenging and dangerous are opportunities for the insurance sector, but someone must take the “Leadership” to organize them, set them as a Project Goal and implement them based on Man and not machines, so that they become real opportunities, with mutual benefit for society, the insured, and Insurance in general. Leadership guides People and Projects, not machines and technologies.

And if we consider that today the fundamental power of customers, together with the development of technology and shifting market boundaries, are driving the insurance industry to institutionally necessary Leadership changes, we immediately understand that we must act. In a specific way, not with the “trial and error” system, nor by reacting simply and casually to what comes, and of course not by remaining apathetic.

These new market situations, the operation and image of today’s insurer, are affected by the shrinking family budget of customers, the tragic situation in social funds, i.e. the reduction in the quality of the level of benefits and functions in pensions and health, and many other smaller insurance issues, which all together have ultimately created a weakness in receivables, and in productivity, and it is likely that it will also cause a decrease in turnover in general.

Consequently, the adage “power of bonding” gains weight in times of crisis, and this in its turn, and whether it works properly with the right Leadership, will offer insurers a future and a promising one at that. The need for networking (collaboration) is recognized in modern Marketing, it is not something new, but it becomes more qualitative and apparent with the participation and use of new technology (Insuretech).

Good Leadership begins with Values and Personality

” The true sign of intelligence is not knowledge, but imagination” Albert Einstein constantly emphasizes to us, wherever and however we study it.

and the research of the Value that a group assigns to its Leader with the following characteristics being the most The most important Qualities of a Leaderprevalent is relevant:

Work Ethic – 82%, Honesty – 80%

Humor – 79%, Confidence – 79%

Positive Attitude – 79%, Correct Decisions – 78%

Passion – 75%, Knowledge – 75%

Kindness – 75%, Calm and Cool – 74%

Good listening – 74%, Personal care – 72%

Intelligence – 71%, Flexibility and Adaptability – 70%

So, Leadership is not a matter of knowledge and intelligence. It is a matter of Character, which perfectly combines the two. And by grouping all these characteristics we end up in six (6) categories, as shown in the diagram: Communication – Motivation – Positivity – Creativity and Feedback.

These are the “attractive parts” of the quality Leader, and which can be assessed by everyone, so that there is gradual development and progress in this function.

Feedback is what will measure the results and conclude how successful, average, or useless they were.

And Peter Bregman’s Leadership theory with the “4Cs” is very relevant here, which states that great Leaders demonstrate basically four (4) elements in their character (traits) to inspire action and achieve the six (6) features, and especially the last, but not the least, “Feedback” without which we will not know the benefit or harm of all actions. The four traits are Confident, Connected, Committed, and Courageous.

for a strong leadership presence… the four “C’s” must work simultaneously. When we are Confident, everything excites us, but we are disconnected from people.

When we are connected (Connected), without confidence (Confidence), we betray our needs and perspectives with others. When we are not Committed to our goals and priorities, we fail to focus on the bottom line. When we do not act strongly, decisively, with courage (Courageous), our ideas remain thoughts and our goals … unfulfilled.

To lead effectively we must combine the “4C’s” – Confident, Connected, Committed, Courageous. Most of us are only good at one of the four, maybe two.

But they are all trainable and can be mastered…

The result of all these characteristics and criteria creates Leadership Standards, depending on the personality of each Leader, but also the type of goal or business one leads:

Autocratic – Dominant model (Confident) – The leader decides alone and gives orders to be executed.

Democratic – Participatory pattern (Committed) – considers the opinion and needs of the group or asks for participation in the decision-making process.

Authoritative – Guiding model (Connected) – here the team makes decisions on its own, and consults the Leader as needed for new knowledge and experiences in each case. The responsibility remains with the Leader, and therefore it is the one who undertakes to coordinate. And when the leader takes responsibility into one’s own hands, then the individual’s right to participate is taken away.

Situational Leadership and trends in the insurance landscape

“The bad news is that time flies. The good news is that you are the pilot” Michael Altshuler tells us, and he is right, because Leadership also means Timing.

The insurance landscape is changing dramatically, at a faster rate of change than we have seen to date, due to two key Trends: greater customer expectations (the Human) and accelerating technological evolution (the Project).

For the insurance sector to harness Leadership as a means to achieve its new work and properly guide major changes through its people, it must have growth in everything. Growth in the Clientele with more frequent Contacts, growth in Production with prioritization of needs according to the range of risks insured, and growth in the Empowerment of all partners, employees, teams. The Determinants of Insurer Success, such as turnover, quality of service provided, levels of innovation required, research and development which is necessary but now easier with technology (IoT), need Leadership. There is no other way.

The predominant form of Leadership for the Insurance Sector is Situational Leadership.

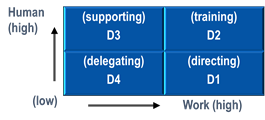

More specifically, the Hersey and Blanchard Model states that there is no single optimal leadership style, and that successful leaders adapt their style based on the “maturity of each team member.” This is followed by the ability and confidence of the team they lead. Only Situational Leadership can deliver this in the Insurance Industry today, with so much to be done at sector, enterprise, distribution network and insured level.

The four forms of leadership execution presented in this theory are: Training, Supporting, Guiding and Delegating.

To describe here as essentially as possible, the main responsibilities of Situational Leadership are summarized in its characteristic features which are:

Flexibility – Adaptation – Direction (at the level of action)

Education – Involvement – Empowerment (at the relationship level)

Integrity – Courage – Humility (at the personality level)

All these features boil down to two axes:

- Focus on the Project, i.e. Objectives, Tasks, Evaluation to get the job done as quickly and qualitatively as possible with the least cost and the greatest benefit

- Focusing on the Human, i.e. Building Ethic, Right Relationships, Communication, Motivation, Training, all in a way to make the most of everyone’s contribution and participation.

As shown in the diagram, our combined selection yields the four (4) leadership styles, which are 100% situational. It adapts according to the occasion, as its name says. Depending on the axis that predominates in each case, the Leader adapts to the situation either by delegating (when no particular leadership involvement is needed), or by helping (when the axis that predominates for the result is the Human), or by guiding (when the axis that predominates for the result is the Project), or Training when both are of great and combined importance to the achievement of the group’s goals, under the Leader’s blessings.

“Walk with the dreamers, the courageous and the happy, with those who plan and believe… Successful people have their heads in the clouds and their feet on the ground” says Wilfred Peterson

And how right he is when significant insurance opportunities will present themselves to those who are ready to respond. The year 2022 is already feeding us with scenarios that create significant insurance opportunities in the demands of a new generation of customers, in changing risks, and in the rapid adoption of technology by the customers themselves. The viability of the insurance industry is vitally linked to these customers. If we lose touch with them, then we will lose our jobs Denise Garth emphasizes on January 13, 2022 in her article.

Conclusion

The world of Insurance is changing. Technology is everywhere, diversity is essential, and the line between personal and professional continues to blur. These changes present a once-in-a-generation opportunity for business, public, and societal leaders to rethink how work is done, reshape the workforce and empower people, wherever they work.

To achieve my goal … I must change …

Here, too, I need to differentiate my attitude, my way of thinking, the way I perform my tasks and duties. The most important thing is to become or remain a Leader.

The Insurer as a “fighter” is already a Leader in all the above, but this is where he needs to differentiate himself additionally in the way others see him, to be able to work Situation-wise and with Feedback. This is what we are missing today with what is changing around us.

Why change? Because it is a must – Because I need to – Because I want to

How much change is needed? Enough to keep up with the market, enough to keep me on the job, enough to satisfy the team, the partners, the insurance company, the superiors,

Enough to satisfy our goals

And that is essentially the situational part of the Leadership that we need today to go into the next decade strong, to continue alone or with our successors, what we started.

Strong people are motivated by their deep sense of purpose.

“In our life, there is no more precious moment than that of the victorious effort, and you will work very hard and for years to relive it” – – Charles Garfield in his book Peak Performance

The video here, which can be watched in English, is useful and enlightening:

https://youtu.be/wJO5IADnlxw – What is Situational Leadership? Getting the Best from People, Day-to-Day