The foundation for financial success and wealth utilization

Written by George Natar – B.Sc, M.Sc, MCyHRMA – Certified Business and Insurance Trainer

April 2023

Introduction

Financial science refers to the virtues required to make decisions in the management of money, investments and in general the personal finances of each citizen.

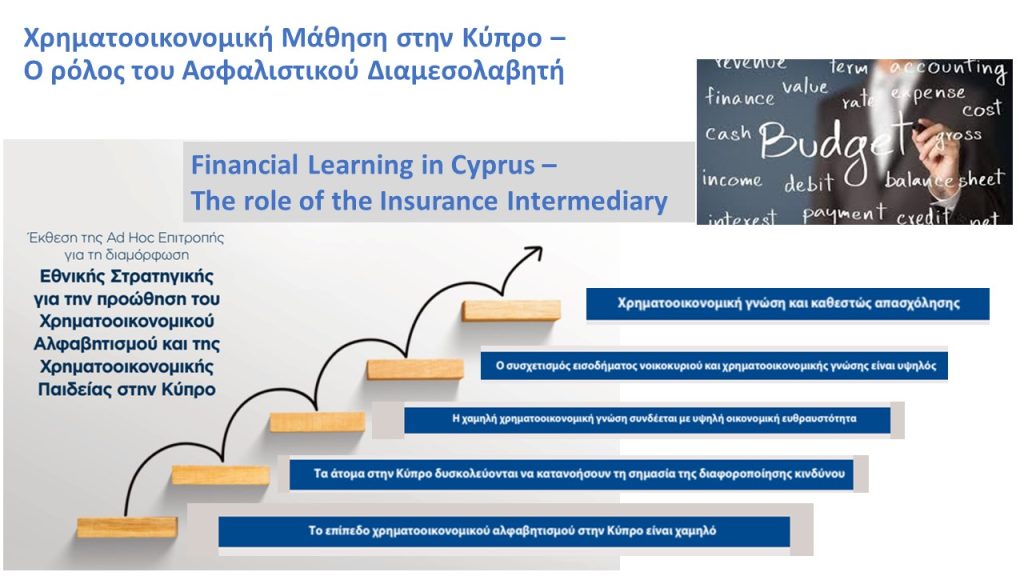

Research on financial learning in Cyprus revealed that:

- The level of learning in Cyprus is low – only 1/3 have knowledge

- The concept of risk diversification is not understood, despite the crises – only 51% do

- The concept of compound interest is not understood – only 44% know

- A consequence of low financial learning is high financial sensitivity in case of loss of income

- Students who learn economics at school have a much better financial knowledge.

- Young people in Cyprus have lower financial knowledge than the rest of the population, and only 1/5 participate in decision-making centers

- Citizens with tertiary education significantly outperform citizens with secondary education in fianancial knowledge.

- Households with financial knowledge have higher incomes on average

- People with financial knowledge have on average better and more employment (work)

- Households with at least one person with financial knowledge diffuse knowledge more than those without.

Reasons for dealing with Finance

Financial literacy is vital for every member of society, working or not, for several reasons which are summarized below:

- Social Contribution: A society with financially literate individuals leads to a more stable and robust state economy. When people make good financial decisions, they contribute to a healthy economic environment, which benefits society as a whole.

- Financial Independence: Financial literacy is the key to achieving financial independence, allowing you to choose your desired lifestyle with confidence and assurance for peace of mind that positively impacts quality of life.

- Investing and Wealth Creation: Financially literate individuals understand the principles of risk and return, asset allocation and diversification that are vital to building a successful investment portfolio.

- Retirement planning: The economic philosophy allows for the planning of a safe and comfortable retirement. It offers options to maintain a desired standard of living in retirement through a combination of welfare, social security, savings and investments.

- Budgeting and Saving: Budgeting and saving are essential tools for stability and systematicity in debt repayment and helps control spending and saving. There is a better understanding of borrowing to pay off debts and reduce the impact of extraordinary financial situations.

- Decision-Making: enables rational decisions, with an understanding of the consequences and with the selection of the most appropriate financial instruments. It supports financial success for the benefit of children and future generations.

Strengthening Financial Learning

In the old days in Cyprus, people used to say a lot about economics, and therefore this science is not new. It’s always evolving. For example they said:

“Where he spends thirty-two, he always spends thirty ” showing the correct relationship between income and expenses

“If this is an apple tree, it will bloom” implying the risk of investment

“Hear big vineyard and get a small basket” controlling the risk they have to take

” I crook and sell, you see and buy ” and carefully choosing their purchases.

The Circle of Money is heptagonal. Seven verbs. Each with its own analysis and preoccupation, which are at the same time the goals that must be determined so that it can be used for the benefit of all. How much does one have to do to acquire financial education:

- I earn (work – income)

- I am insured (protection – welfare)

- I Borrow (liquidity – financing)

- I Save (insurance – emergency)

- I Donate (charity – society)

- I Invest (development, exploitation)

- I consume (needs – desires)

Scientific research proves that strengthening financial learning is a global challenge and has been directly linked to the well-being of citizens and maximizes the potential to achieve personal goals. Strategic goals of financial learning:

- Awareness about economic learning

- Empowerment with knowledge and skills

- Need for adequate planning for insurance and retirement

- Use of digital financial products and their risks

All these… through education, lifelong learning, and access to specialized information

Why is financial literacy important? Financially literate people make more conscious actions and are able to manage their income through:

- Budget

- Insurance and risk transfer

- Investments

- Debt management, savings and use of an emergency fund

- Planning for the future and retirement

Benefits of adequate financial management are lower likelihood of over-indebtedness, increased employment opportunities and increased demand for insurance coverage. Also, better retirement planning is achieved due to the increased possibility of earning higher wages and higher participation in financial markets.

Financial literacy and the role of the insurer

The Insurer is the person who is closer, on a personal level, to the citizens and businesses of Cyprus. Insurance, anyway, is a part of Finance. Therefore, the duties and role of the Insurance Intermediary in relation to the description of its function are:

On a personal level

- Maintaining the standard of living of our fellow human beings

- Ensuring the institution of the family

- Protection of old age

- Securing young people

- Development of our country’s economy

At a Professional Level

- Identifies prospective customers

- Investigates insurance needs

- Proposes solutions to needs

- Supervises the conclusion of the contract

- Serves the insured by providing quality services.

The Insurer serves, advises, recommends, and protects the citizen. He has a duty to the state and the buying public. So, we must assume a key role and initiative in the financial education of the Cypriot citizen, entrepreneur, retiree.

In my next article we will begin to describe and analyze basic financial principles in an attempt to start a titanic effort to participate in the goal of achieving financial literacy, which our country and our customers so need today.

Conclusion

What virtues are achieved through financial literacy?

- growth mindset and belief in our thoughts and actions

- clear financial goals and efforts to achieve them

- transfer and insurance of uncontrolled risks

- orientation to opportunities

- adoption of successful models

- self-promotion and image as key tools for success

- creating timeless wealth

- prioritizing liquidity over employment income

- lifelong learning and continuous updating in financial strategies

- investing in income generating opportunities